VA Entitlement Explained: What $36,000 on Your COE Really Means

What Does $36,000 in VA Entitlement Really Mean? - A Clear Guide for Veterans, Agents, and Lenders

VA entitlement explained clearly. If your Certificate of Eligibility (COE) says $36,000, that number can be confusing. But it’s not a cap - it’s the start of your full VA benefit.

Let's set the record straight:

VA entitlement is not a balance. It's a guarantee.

When a lender makes a VA loan, the VA promises to cover part of the loss if the veteran defaults. That guarantee makes lenders confident enough to offer $0 down loans to qualified buyers.

What the $36,000 Actually Means

The COE often lists "basic entitlement: $36,000." Here's the breakdown:

- The VA guarantees 25% of a loan.

- $36,000 is 25% of $144,000 (an old loan limit from decades ago).

So when your COE says $36,000, it's not a cap on what you can buy. It's a green light that you have full entitlement available.

With full entitlement, the VA will guarantee 25% of whatever loan amount you qualify for, and there's no VA-imposed limit. Your approval depends on credit, income, and lender guidelines - not that $36K figure.

Simple Script to Remember:

"The number on your COE is how much the VA promises your lender, not how much house you're allowed to buy."

Full Entitlement = Wide Open Benefit

You have full entitlement when:

- You're not currently using any of it on another VA loan.

- You haven't lost entitlement due to a prior foreclosure or claim.

In that case:

- There's no VA loan limit.

- You can go zero down, assuming lender approval.

Partial Entitlement: Still Powerful, Just More Math

Partial entitlement happens when:

- You still have a VA loan on a home.

- You had a previous VA loan foreclosed or charged off.

The VA might still guarantee another loan, but if your remaining entitlement doesn't reach 25% of the new loan amount, you'll need to make a down payment to cover the gap.

Analogy:

“Think of entitlement like a $1,000 safety net. If $600 is already in use, you still have $400 left for another deal - but the lender might want you to add some netting of your own.”

Can You Have Two VA Loans at Once? Yes.

The old myth that you can only have one VA loan at a time just isn't true. You can have multiple VA loans if:

- You have remaining entitlement.

- You meet occupancy and lender rules.

It's all math - and VA math can work in your favor when handled by experts.

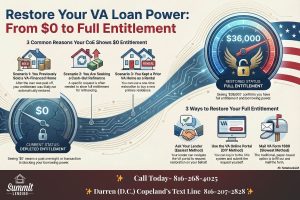

Why COEs Sometimes Show $0 Entitlement

A COE with $0 entitlement doesn't always mean you're ineligible. Here are five common reasons:

- Not enough qualifying service yet

- Entitlement tied to a special VA benefit (like Native American Direct Loan)

- Previous VA loan claim used up all entitlement

- Flagged COE (needs VA review)

- Data or system error

Plain Explanation:

“If your COE says $0, it usually means VA needs more info - about your service, a past loan, or a special rule. It doesn't mean your benefit is gone.”

How to Restore Your Full Entitlement

If your entitlement is tied up, you can restore it by:

- Selling your old VA-financed home.

- Refinancing into a non-VA loan.

- Paying off the loan and filing a restoration request.

- Requesting restoration one-time for rental conversions.

Now that you have VA entitlement explained, you can confidently review your Certificate of Eligibility

Bottom Line: Don't Go It Alone

The rules make sense once you know the language, but that's why it's critical to work with people who live and breathe VA lending. Whether you're a veteran, a real estate agent, or a loan officer helping someone else, clarity builds confidence - and confident buyers build wealth.

Here is a link to our You Tube Channel VA eligibility videos. DC breaks it down in a slower longer video that is about 5 minutes that we have provided a link for. The Short Version is below and you just need to click on it.

DC’s 5 minute Video breaking down VA entitlement

Summit Lending | VA Loan Specialists